Neurology has finally put an end to the great argument about which online payment method is best and more trusted by the consumer. On variables such as reward, security and affection, the debit card is the big loser while PayPal comes out on top as a trust generator.

Online commerce is growing, but so are concerns about payment methods.

The rise of e-commerce is an undeniable and unstoppable reality where the transition from "offline" to "online" is becoming increasingly clear in, for example, cinemas, supermarkets, banks, travel and even cars.

However, in Spain, according to the ECB, 87% of transactions are carried out in cash, being only surpassed by Malta (92%); Greece (88%) or Cyprus (88%) with respect to the online payment method.

So why is cash still the king of transactions? Mistrust is the main reason why Spaniards do not use these "abstract" means of payment where you enter your bank details and wait with more or less hope for the purchased good to arrive. And if we also add online shops with numerous invasive advertisements, a rudimentary interface and windows that pop up continuously, entering your current account number becomes a high-risk sport suitable only for the bravest.

Paypal, the best online payment method

Several traditional studies have tried to analyse and clarify, to no avail, that online payment method is better for the consumer. The University of Granada (UGR) together with the Universidad a Distancia de Madrid (UDIMA) set out to put an end to this debate objectively.

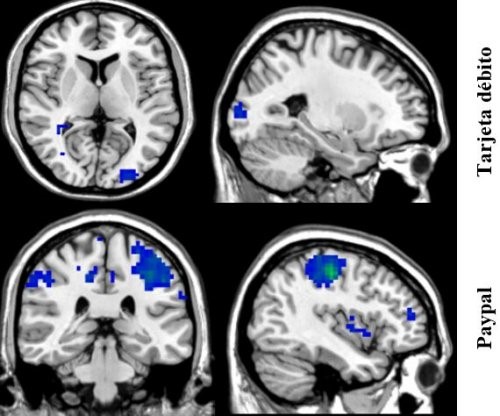

The experiment consisted of an MRI scan of a sample of 30 people who had shopped online in the last few months. The MRI scan measured the subjects' brain activity when choosing a product. form of payment on items with little reflection on acquisition (books or cinema tickets).

The results were enlightening. The debit card activated areas of the brain associated with negative feelings, while PayPal activated areas responsible for positive values such as reward, security and affection. It is not surprising when 23% of consumers say that ease of payment is the main reason for completing a purchase (Source: Observatorio Cetelem).

The study also highlighted another of the risks that consumers take when shopping online; the failure to meet expectations. These expectations, if broken (late delivery, defective or very different product from the one advertised) generate a greater negative response in the brain than the actual form of payment.

Tell me how they can pay you, and I'll tell you if they will.

22% of consumers abandon their purchase because they cannot find payment methods that meet their needs (Source: IAB Spain). A large percentage of sales that do not end up closing and not for market or competition reasons, which are more difficult to control. Simply because of a mistake that is so easy to solve. Science has already pronounced itself, there are no excuses left; provide your online shop for the best payment methods.

[yop_poll id="6″]

Would you like to subscribe to our newsletter?

Receive information on digital marketing, strategic marketing, market research and much more.

[contact-form-7 id="5548″ title="Newsletter subscription"]